Ali Gillani

General Manager

Trans Atlantic Gem Sales

In my previous article, I mentioned that a well-respected diamantaire from the industry asked me a question about the term Illusion. The same gentleman read my article, and has suggested that I research and write another article.

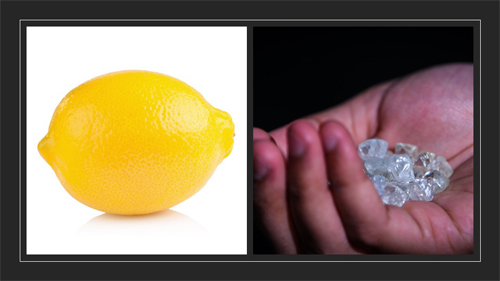

The topic is the Lemons Problem and how we can relate it to the Rough Diamond Business?

Before I begin, I would like to explain in brief, what is the lemons problem?

The Lemons Problem:

The term Lemons Problem was coined by a behavioral economist and a Nobel Prize Winner Geroge A. Akerlof, in his research paper The Market for Lemons: Quality Uncertainty and the Market Mechanism, published in 1970.

The lemons problem occurs due to an imbalance of information between a seller of a product and its purchaser. The imperfection of knowledge possessed by the buyer and the seller in a business transaction is also known as Asymmetric information.

Akerlof's paper uses the market for used cars as an example of the problem of quality uncertainty. It concludes that owners of high-quality used cars will not place their cars on the used car market. A car buyer should only be able to buy low-quality used cars and will pay accordingly. The market for good used cars does not exist.

THE LEMONS PROBLEM IN A ROUGH DIAMOND BUSINESS:

I have given a brief explanation of the meaning of the Lemons Problem in the first section of this article and the link to study it in detail. Also, of particular interest, to learn how the Lemons Problem leads to market failure.

Since the topic of the article is specifically to relate the Lemons Problem with a rough diamond business transaction, I would like to make it easier for readers to understand by giving a real-life business example:

Business on a table:

Assume a rough diamond dealer has a +21 sieved size mixed parcel of a total 10,000 CTS. The seller knows the exact variation of sizes and quality but proposing it as a mixed parcel to the buyer.

As per the seller’s evaluation of the mixed parcel, half of the goods are of high-quality @ $200/-Ct, and half of the low-quality@ $80/Ct.

Consequently, the seller is expecting a total @ $140/Ct for the parcel.

The buyer enters seller’s office with a plan to purchase high-quality goods @ $250/Ct and low-quality goods @ $140/Ct.

Now here we discuss two situations:

Situation # 1:

The buyer understands how to evaluate the price of the rough goods, and he is aware of prevailing market prices.

In the given situation, the buyer does the correct assortment and grading of the parcel, and he concludes the business in the following price ranges:

High-quality goods range between $200 to $250 per carat.

Low-quality goods range between $80 to $140 per carat.

The total value of the business will be in the range of $1,400,000 to $ 1,950,000

Situation # 2:

The buyer has the know how to assess the prices of the rough diamonds, but he is unsure of the relative quality and quantity of the different goods in the parcel.

In the given situation, the confusion makes a massive impact on the purchasing decision, and the buyer reduces his price to 50% for both quality goods.

Due to the complexity of the parcel, the buyer offers on average:

@ 50% X $250 = $125/Ct X 5,000 CTS = $625,000 for the high-quality goods

@ 50% X $140 = $70/Ct X 5,000 CTS = $350,000 for the low-quality goods.

The buyer offers the parcel $975,000 or $97.50/CT

The deal does not end successfully. The buyer confusion and lack of information about the relative quantity and quality of rough diamonds in the parcel provide an opportunity for the seller to revisit the mixed parcel. He takes out 50% high-quality goods and changes with low-quality and sets a new offer @ $97.50/CT to the next confused buyer.

This is a perfect example of the Lemons Problem in the Rough Diamond Business. The imbalance of information gives an incentive to the seller to sell his low-quality goods $17.5/CT more than his reserve price, and the buyer misses a chance to close the deal because of his uncertainty about the mixed goods.

It is a very undesirable outcome, and in the long run it destroys the market price of high-quality goods. It is a market failure due to Asymmetric Information or specifically due to adverse selection as the buyers are worried about the bad selection. The investors get out of the Lemons Market because of the shady business.

THE SOLUTION OF THE LEMONS PROBLEM IN THE ROUGH DIAMONDS BUSINESS:

The best way to overcome the Lemons Problem in a rough diamond business transaction and what buyers can do to balance the scale, is to BUY ONLY FROM A REPUTABLE ROUGH DIAMOND TENDER HOUSE:

REASONS:

• Study the Stones:

Tender sales provide buyers sufficient time to study and review the goods thoroughly. The buyer uses proper tools for correctness and eliminates confusion. Tender house provides standard assortments of parcels to make it easier for a buyer to avoid shady mixed business on the table.

• Previous Purchase History:

Previous buying history and availability of earlier event results helps the buyer to have an idea of the projected price and yield of the goods. A similarity in buying patterns could improve the profits on purchases and provides confidence to the buyer when making a decision.

• Honest & Transparent Business Approach:

The tender house that follows fair and honest business practice rules always seeks the confidence of a buyer. They always inform buyers in case the submitted offers by the buyers during the event are way higher than the reserve price set by the producers. A reputable tender house always favors retaining a buyer by presenting the correct details of the goods and their origin. A tender house cannot afford to offer illegal or conflict goods to wreck its business reputation.

• Price Stability:

A tender house with a good reputation always bargains on the reserve prices set by the producers of the goods that are not realistic or are not in-line with the prevailing market prices before the commencement of the event. The buyer joins a tender event with a clear understanding that he is attending an event where he can buy the goods because of realistic and correct prices.